Apple Card and Its Savings Account Are Great, And Why I’m Still Not Sold

On Tuesday, Apple launched its latest foray into the financial sector: a Savings account tied to the Apple Card (which I will refer to as ‘Apple Card Savings’). From the Apple Newsroom press release:

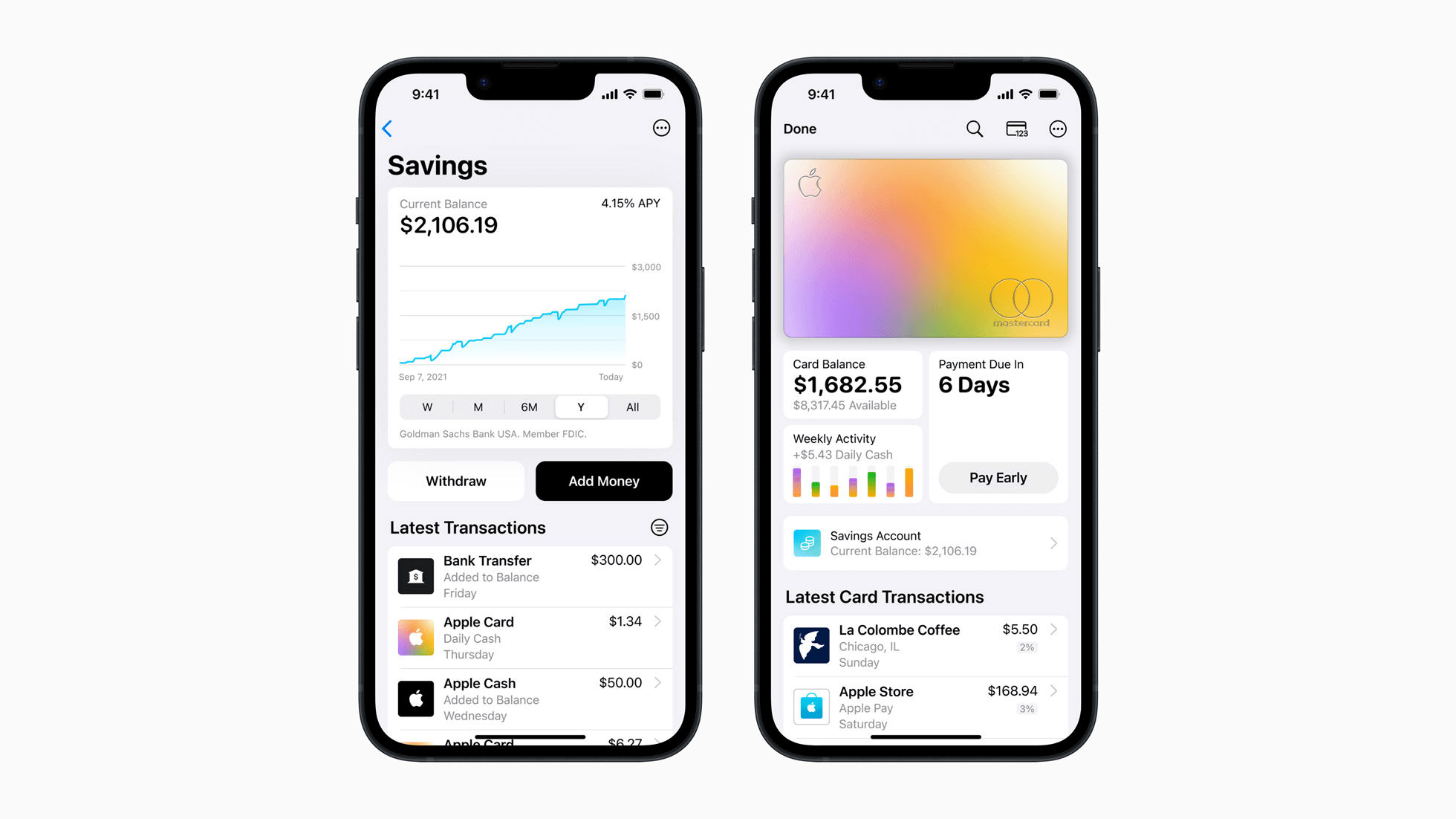

Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent — a rate that’s more than 10 times the national average. With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet.

[…]

Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.

We knew that Apple was aiming to be competitive — they cited the Savings account was going to be a “high-yield” account before it was officially released — but the internet at large seemed surprised at just how good of an interest rate Apple secured for its customers out of the gate at 4.15%. That’s much, much higher than most savings accounts, and among the best that any day-to-day consumer can get today. Add in the slick dashboard and easy sign-up process — just a few taps through the ‘More’ menu of your Apple Card in the Wallet app, plus entering your Social Security Number1 — and I’d say it’s a big winner for customers.

Where Apple Card Shortchanges Us

That being said, I don’t foresee myself moving a bunch of money over to my Apple Card Savings, even though that’s something I could very easily do using Apple’s tools in the Wallet app. That’s because I already have a high-yield cash account through Betterment’s Cash Reserve that I like. And it’s currently sporting an interest rate of 4.20%. (Interest rates through both Betterment and Apple Card Savings are subject to change at any time.) But more importantly, it’s shared with my wife, who can access the account the same as I can. From what I can tell, Apple Card Savings allows each co-owner of an Apple Card Family account to create their own Savings, but not a common pool:

If you have Apple Card Family, only account owners and co-owners can set up Savings accounts.* Each Savings account holder will only be able to see their own account balance and details in Wallet.

*At this time, Participants aren’t eligible to set up Savings.

Everyone does money differently, but at least for my partnership with my spouse, we shared everything. The notable exception is the Apple Card, for reasons I’ll get to below. But the result is that it doesn’t make sense for me to transfer money out of one of our shared pool into another that only I have access to — especially since it wouldn’t come with any interest-earning benefit.

As for why we don’t share access to the Apple Card. Well, that’s another case of Apple getting really, tantalizingly close to an ideal product, but not quite getting it over the finish line. You see, the big draw of the Apple Card is the Daily Cash — of which I’m a big fan. Every day you’re reminded the benefits, the free money (provided you pay off the balance before it accrues owed interest) that it earns for you. 3% back for anything bought at Apple, 2% for anything purchased using NFC tap-to-pay, and 1% anytime the physical titanium card is swiped or its card number is used (i.e. online not through Apple Pay, or over the phone). The thing is, there are still a lot of places, both online and in-person, that Apple Pay isn’t accepted. Which means a lot of our transactions would earn just 1% cash back. Instead, we’ve used and loved the Citi DoubleCash card for years. Its shtick is that you earn 2% back on everything. Every purchase, no matter how it’s made.2

So why would I use the Apple Card for anything other than Apple purchases that earn that sweet, sweet 3% daily cash? The answer is, I wouldn’t and I don’t. Apple Card pays for my apps, subscriptions, and Apple devices, and that’s about it.3 The DoubleCash card rewards are simpler to understand, and earn us more money back.4 So, instead of cluttering my wife’s wallet with another card that she wouldn’t want to use anyway, we have an understanding that it’s attached to my Apple ID and pays for just those purchases (which are ultimately shared with her through Family Sharing anyway).

Another strike against using Apple Card day-to-day is that getting its transactions out of Apple Wallet and into something that has a broader view of my finances, like Copilot or Mint, is a pain the ass. You literally have to export a CSV file of the transactions each month, like an animal! Instead, I’ve got Copilot hooked up directly to my Citi account through Plaid, so every transaction is automatically loaded into my budgeting app of choice.

Okay, Getting to the Gold

I’ve prattled on about Apple Card and its Savings account’s shortcomings enough. There is at least one thing that I’m glad for, and it’s why I’ve turned on the Savings account in the first place: it finally separates my Daily Cash earnings from the peer-to-peer payments I do through Apple Cash.

For the uninitiated, Apple Cash (the artist formally known as Apple Pay Cash), is like Venmo or Cash App in that you can send money back and forth to other Apple Cash users. And it’s primarily done through the Messages app, which is pretty convenient since that’s where my friends and family discuss those friendly transactions anyone. It keeps the conversation and payment in context. It’s super easy and free, and you can even spend that money out of your Apple Cash account anywhere you can use Apple Pay.

But why is diverting the Daily Cash earnings out of Apple Cash and into Apple Card Savings5 better? Mainly because I think of the meager Daily Cash as “extra fun money” that I can choose to save up or spend frivolously. And if I need to send money to a friend to cover something that would otherwise come out of my budget, like for a meal or to cover part of a bill, it’s instead spending money out of that “fun fund”. I’ve deliberately chosen to use Cash App instead of Apple Cash because I can more accurately budget transactions there as they flow through our regular checking account.

Now, with Daily Cash safely tucked away (and earning interest!) in Apple Card Savings, I can go back to using Apple Cash as a intermediary for the checking account when doing to those peer-to-peer payments.

High(-Yield) Hopes

I used to be nervous about Apple tip-toeing into the financial world. I thought it would be a distraction from their core products, and it just seemed kind of, well, icky to do any sort of banking with my favorite tech company. But Apple, these days, is far more than just a technology juggernaut. They’ve proven that they can walk and chew gum. And while we feared that Apple Card would tarnish their brand since they’d ostensibly have to go “shake down” folks who didn’t pay back their loans, I’ve yet to hear any story of an unpleasant interaction in that regard. It could be that Goldman Sachs is bearing that grunt work and I’m just not hearing about it, but I’m pleased that it seems to be working well for both customers and Apple.

However, if Apple wanted to make it a no-brainer for even more its customers like me to default to using the Apple Card for everything, I think they need to take their, admittedly already-pretty–simple-compared-to-other-credit-card-labyrinth-point-systems, rewards program and take it a step further. I suggest making it a plain and simple 3% daily cash back for everything, but would accept a 2% minimum and higher percentages earned with special partnerships.

I truly do believe Apple when they say that one of their goals with Apple Card, their monthly installments program, and the also-new Apple Pay Later loans, is to “build tools that help users lead healthier financial lives.” Their “no fees” approach, easy-to-understand financial dashboards, and encouragement to pay off loans before they accrue interest are all very customer-first. With a few additional steps toward being more sharing-friendly and better integrated with the rest of the finance software world, they could earn more credibility, and, ultimately, more business.

I’ll note for the record that when I first tried to apply for Apple Card Savings, my application was denied by Goldman Sachs, and I was told I could contact contact them for more information. I didn’t contact Goldman Sachs, and instead just tried to apply again a minute or so later. I wasn’t prevented from trying again, and my second application was approved lickity-split. Perhaps the application process was just overloaded on day one, I don’t know.↩︎

Technically, you earn 1% at the time of purchase, and the other 1% when it’s paid off. But for all intents and purposes — again, especially if you pay off the full balance every month — you’re getting 2% back on everything.↩︎

Oh, and any transactions we make on trips out of the country. Because there are no foreign transaction fees with the Apple Card, unlike the Citi DoubleCash card. Which is pretty ironic, considering that Apple Card is not yet available outside of the U.S. four years on from its introduction.↩︎

Enough that it’s consistently covered all our Christmas gift purchases the last few years! There’s a benefit to letting it build up all year, untouched and unchecked, and then reveling in all that “free money”.↩︎

Alright, this is becoming a mouthful approaching the scale of “watching Apple TV+ in the Apple TV app on the Apple TV”.↩︎